TRI Inventory

TRI Reporting Criteria

Toxic Release Inventory

TRI Reporting Assistance

What Is The Toxics Release Inventory?

According to the EPA, TRI tracks the management of certain toxic chemicals that may pose a threat to human health and the environment.

Facilities in different industry sectors must report annually how much of each chemical is released to the environment and/or managed through recycling, energy recovery and treatment.

The information is compiled in the Toxics Release Inventory, which is used to support decision-making by companies, government agencies, non-governmental organizations and the public.

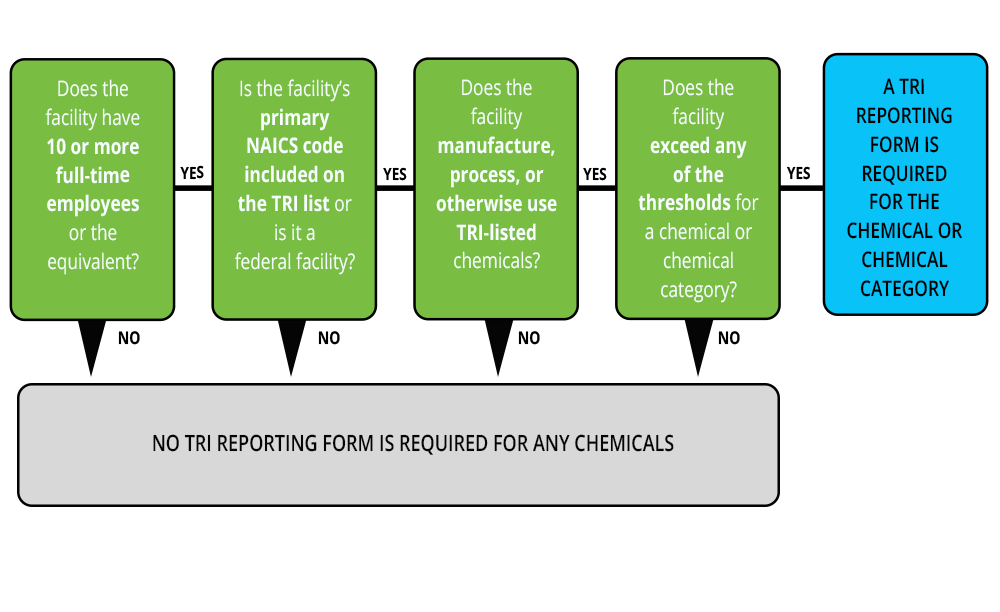

Reporting Criteria

If a facility meets the employee, industry sector, and chemical threshold criteria, it must report to the TRI Program.

Which Industry Sectors Are Included in TRI Inventory?

NAICS Sector 212 - Mining

This sector covers the following mining-related industries:

2121 – Coal Mining

- All six-digit codes are covered.

2122 – Metal Mining

- All six-digit codes are covered except for Iron Ore Mining (212210).

2123 – Nonmetallic Mineral Mining & Quarrying

The following are covered:

212324 – Kaolin and Clay Ball Mining

- Required for facilities operating without a mine or quarry and that are primarily engaged in beneficiating kaolin and clay.

212325 – Clay and Ceramic and Refractory Minerals Mining

- Required for facilities operating without a mine or quarry and that are primarily engaged in beneficiating clay and ceramic and refractory minerals.

212393 – Other Chemical and Fertilizer Mineral Mining

- Required for facilities operating without a mine or quarry and that are primarily engaged in beneficiating chemical or fertilizer mineral raw materials.

212399 – All Other Nonmetallic Mineral Mining

- Required for facilities operating without a mine or quarry and that are primarily engaged in beneficiating nonmetallic minerals.

NAICS Sector 212 - Utilities

This sector covers electric utilities and water and sewage utilities,

2211 – Electric Utilities

- All six-digit codes are covered.

- Reporting is only required for facilities that combust coal and/or oil for the purpose of generating power for distribution in commerce.

221330 – Steam and Air-Conditioning Supply

- Reporting is required for facilities engaged in providing combinations of electric, gas, and other services, not elsewhere classified, and that combust coal and/or oil for the purpose of generating power for distribution in commerce.

NAICS Sector 424 - Merchant Wholesalers, Non-durable Goods

The following categories are covered:

424690 – Other Chemical and Allied Products Wholesalers

424710 – Petroleum Bulk Stations and Terminals

NAICS Sector 425 - Wholesale Electronic Markets and Agents Brokers

All six-digit codes are covered, with the following caveats:

425110 – Business to Business Electronic Markets

- Reporting is only required for facilities previously classified in SIC 5169, Chemicals and Allied Products, Not Elsewhere Classified.

425120 – Wholesale Trade Agents and Brokers

- Reporting is only required for facilities previously classified in SIC 5169, Chemicals and Allied Products, Not Elsewhere Classified.

NAICS Sectors 31 - 33 - Manufacturing

311 – Food

311811 – Retail Bakeries

- No reporting necessary

311119 – Other Animal Food Manufacturing

- Reporting is not required for facilities primarily engaged in Custom Grain Grinding for Animal Feed.

311340 – Non-chocolate Confectionery Manufacturing

- Reporting is not required for facilities primarily engaged in the retail sale of candy, nuts, popcorn and other confections not for immediate consumption made on the premises.

311352 – Confectionery Manufacturing from Purchased Chocolate

- Reporting is not required for facilities primarily engaged in the retail sale of candy, nuts, popcorn and other confections not for immediate consumption made on the premises.

311611 – Animal (except Poultry) Slaughtering

- Reporting is not required for facilities primarily engaged in Custom Slaughtering for individuals.

311612 – Meat Processed from Carcasses

- Reporting is not required for facilities primarily engaged in the cutting up and resale of purchased fresh carcasses for the trade (including boxed beef), and in the wholesale distribution of fresh, cured, and processed (but not canned) meats and lard.

312 – Beverage & Tobacco Products

312112 – Bottled Water Manufacturing

- Reporting is not required for facilities primarily engaged in bottling mineral or spirit water.

312230 – Other Tobacco Product Manufacturing

- Reporting is not required for facilities primarily engaged in providing Tobacco Sheeting Services.

313 – Textile Mills

All six-digit codes are covered, with the following caveat:

313310 – Textile and Fabric Finishing Mills

- Reporting is not required for facilities primarily engaged in converting broadwoven piece goods and broadwoven textiles, and facilities primarily engaged in sponging fabric for tailors and dressmakers (previously classified under SIC 7389, Business Services, NEC (Sponging fabric for tailors and dressmakers), and for facilities primarily engaged in converting narrow woven textiles, and narrow woven piece goods.

314 – Textile Products

All six-digit codes are covered, with the following caveats:

314120 – Curtain and Linen Mills

- Reporting is not required for facilities primarily engaged in making custom drapery for retail sale, and facilities primarily engaged in making custom slipcovers for retail sale.

314999 – All Other Miscellaneous Textile Product Mills

- Reporting is not required for facilities primarily engaged in binding carpets and rugs for the trade, carpet cutting and binding, and embroidering on textile products (except apparel) for the trade.

315 – Apparel

All six-digit codes are covered, with the following caveats:

315220 – Men’s and Boys’ Cut and Sew Apparel Manufacturing

- Reporting is not required for custom tailors primarily engaged in making and selling men’s and boys’ suits, cut and sewn from purchased fabric, and custom tailors primarily engaged in making and selling men’s and boys’ dress shirts, cut and sewn from purchased fabric.

315240 – Women’s, Girls’ and Infants’ Cut and Sew Apparel Manufacturing

- Reporting is not required for custom tailors primarily engaged in making and selling bridal dresses or gowns, or women’s, misses’ and girls’ dresses cut and sewn from purchased fabric.

316 – Leather and Allied Products

- All six-digit codes are covered with no caveats.

321 – Wood Products

- All six-digit codes are covered with no caveats.

322 – Paper

- All six-digit codes are covered with no caveats.

323 – Printing & Publishing

- All six-digit codes are covered with the following caveats.

323111 – Commercial Printing (except Screen and Books)

- Reporting is not required for facilities primarily engaged in reproducing text, drawings, plans, maps, or other copy, by blueprinting, photocopying, mimeographing, or other methods of duplication other than printing or microfilming (i.e., instant printing).

324 – Petroleum & Coal Products

- All six-digit codes are covered.

325 – Chemicals

- All six-digit codes are covered with some caveats:

325998 – All Other Miscellaneous Chemical Product and Preparation Manufacturing

- Reporting is not required for facilities primarily engaged in Aerosol can filling on a job order or contract basis.

326 – Plastics & Rubber Products

- All six-digit are covered except 326212 – Tire Retreading.

327 – Nonmetallic Mineral Products

- All six-digit codes are covered.

331 – Primary Metals

- All six-digit codes are covered.

332 – Fabricated Metal Products

- Again all six-digit codes are covered.

333 – Machinery

- All six-digit codes are covered.

334 Computer & Electronic Products

- All six-digit codes are covered, with a caveat for one industry:

334614 – Software and Other Prerecorded Compact Disc, Tape and Record Reproducing

- Reporting is not required for facilities primarily engaged in mass reproducing pre-recorded Video cassettes, and mass reproducing Video tape or disk.

335 – Electrical Equipment

- All six-digit codes are covered here also, with one caveat:

335312 – Motor and Generator Manufacturing

- Reporting is not required for facilities primarily engaged in armature rewinding on a factory basis.

336 – Transportation Equipment & Allied Services

- All six-digit codes are covered.

337 – Furniture

- All six-digit codes are covered with some caveats:

337110 – Wood Kitchen Cabinet and Countertop Manufacturing

- Reporting is not required for facilities primarily engaged in the retail sale of household furniture and that manufacture custom wood kitchen cabinets and counter tops.

337121 – Upholstered Household Furniture Manufacturing

- Reporting is not required for facilities primarily engaged in the retail sale of household furniture and that manufacture custom made upholstered household furniture.

337122 – Non upholstered Wood Household Furniture Manufacturing

- Reporting is not required for facilities primarily engaged in the retail sale of household furniture and that manufacture non upholstered, household type, custom wood furniture.

339 Miscellaneous Manufacturing

- ALL six-digit codes are covered except for 339116 – Dental Laboratories. Additionally, there are some caveats:

339113 – Surgical Appliance and Supplies Manufacturing

- Reporting is not required for facilities primarily engaged in manufacturing orthopedic devices to prescription in a retail environment.

339115 – Ophthalmic Goods Manufacturing

- Reporting is not required for lens grinding facilities that are primarily engaged in the retail sale of eyeglasses and contact lenses to prescription for individuals.

NAICS Sector 511, 512, & 519 - Publishing

Within this sector only specific industries must report. The following MUST REPORT:

511110 – Newspaper Publishers

511120 – Periodical Publishers

511130 – Book Publishers

511140 – Directory and Mailing List Publishers

- Reporting is not required for facilities that are primarily engaged in furnishing services for direct mail advertising including address list compilers, address list publishers, address list publishers and printing combined, address list publishing , business directory publishers, catalog of collections publishers, catalog of collections publishers and printing combined, mailing list compilers, directory compilers, and mailing list compiling services.

511191 – Greeting Card Publishers

511199 – All Other Publishers

512220 – Integrated Record Production/Distribution

512230 – Music Publishers

- Reporting is not required for facilities primarily engaged in music copyright authorizing use, music copyright buying and licensing, and music publishers working on their own account.

519130 – Internet Publishing and Broadcasting and Web Search Portals

- Reporting is required for facilities primarily engaged in Internet newspaper publishing, Internet periodical publishing, Internet book publishing, Miscellaneous Internet publishing, and Internet greeting card publishers.

- Reporting is not required for facilities primarily engaged in Web search portals.

NAICS Sector 562 - Hazardous Waste

As expected, there are additional regulations that come into play in this category. Attention to detail is required.

562112 – Hazardous Waste Collection

- Reporting is required for facilities primarily engaged in solvent recovery services on a contract or fee basis.

5622 – Waste Treatment and Disposal

- All six-digit codes are covered with the following caveats:

562211 – Hazardous Waste Treatment and Disposal

- Reporting is only required for facilities regulated under the Resource Conservation and Recovery Act, subtitle C, 42 U.S.C. 6921 et seq.

562212 – Solid Waste Landfill

- Reporting is only required for facilities regulated under the Resource Conservation and Recovery Act, subtitle C, 42 U.S.C. 6921 et seq.

562213 – Solid Waste Combustors and Incinerators

- Reporting is only required for facilities regulated under the Resource Conservation and Recovery Act, subtitle C, 42 U.S.C. 6921 et seq.

562219 – Other Nonhazardous Waste Treatment and Disposal

- Reporting is only required for facilities regulated under the Resource Conservation and Recovery Act, subtitle C, 42 U.S.C. 6921 et seq.

562920 – Materials Recovery Facilities

- Reporting is required for facilities regulated under the Resource Conservation and Recovery Act, subtitle C, 42 U.S.C. 6921 et seq.

All Other Miscellaneous Manufacturing

111998 – All Other Miscellaneous Crop Farming

- Reporting is only required for facilities primarily engaged in reducing maple sap to maple syrup.

113310 – Logging

211112 – Natural Gas Liquid Extraction

- Reporting is required for facilities that recover sulfur from natural gas.

488390 – Other Support Activities for Water Transportation

- Reporting is required for facilities that are engaged in providing routine repair and maintenance of ships and boats from floating dry-docks.

541710 – Research and Development in the Physical, Engineering, and Life Sciences (except Biotechnology)

- Reporting is required for facilities that are primarily engaged in guided missile and space vehicle engine research and development and in guided missile and space vehicle parts (except engines) research and development.

811490 – Other Personal and Household Goods Repair and Maintenance

- Reporting is required for facilities that are primarily engaged in repairing and servicing pleasure and sailboats without retailing new boats.

Federal Facilities

ALL Federal facilities need to conduct TRI.